Munich, home to 1.5 million people, is Germany’s third-largest city and renowned worldwide for Oktoberfest. Munich, however, offers much more than just Oktoberfest, with 47 theatres, 46 museums, and 17 universities adding to its cultural richness. Between January and August 2024, Munich attracted over 6 million visitors from around the world, resulting in more than 12 million overnight stays.

Despite its strong tourist appeal, Simply Munich, the city’s destination marketing organisation (DMO), aims to explore visitor trends in greater detail to gain insights into key market preferences and develop customised offers and campaigns accordingly.

To do so, Simply Munich is partnering with The Data Appeal Company to gain a better understanding of visitors’ preferences for different neighbourhoods in the city:

- Which are the most popular neighbourhoods?

- Which areas, although not the most visited, have an excellent Sentiment Score?

- Where do European visitors, particularly Italians, French, and Poles, spend their time?

- Are there any behavioural differences depending on the type of traveller?

- Do visitor numbers vary throughout the year, and if so, how do they change?

Using the destination marketing and management platform D / AI Destinations, we were able to get the answers Simply Munich was looking for—in just a few clicks.

All the data presented in the analysis refers to the period from January to October 2024.

Altstadt tops the list for reviews, but sentiment is surprisingly higher in other areas

With the help of Simply Munich, we carefully selected and analysed each neighbourhood in the city.

What are the key takeaways?

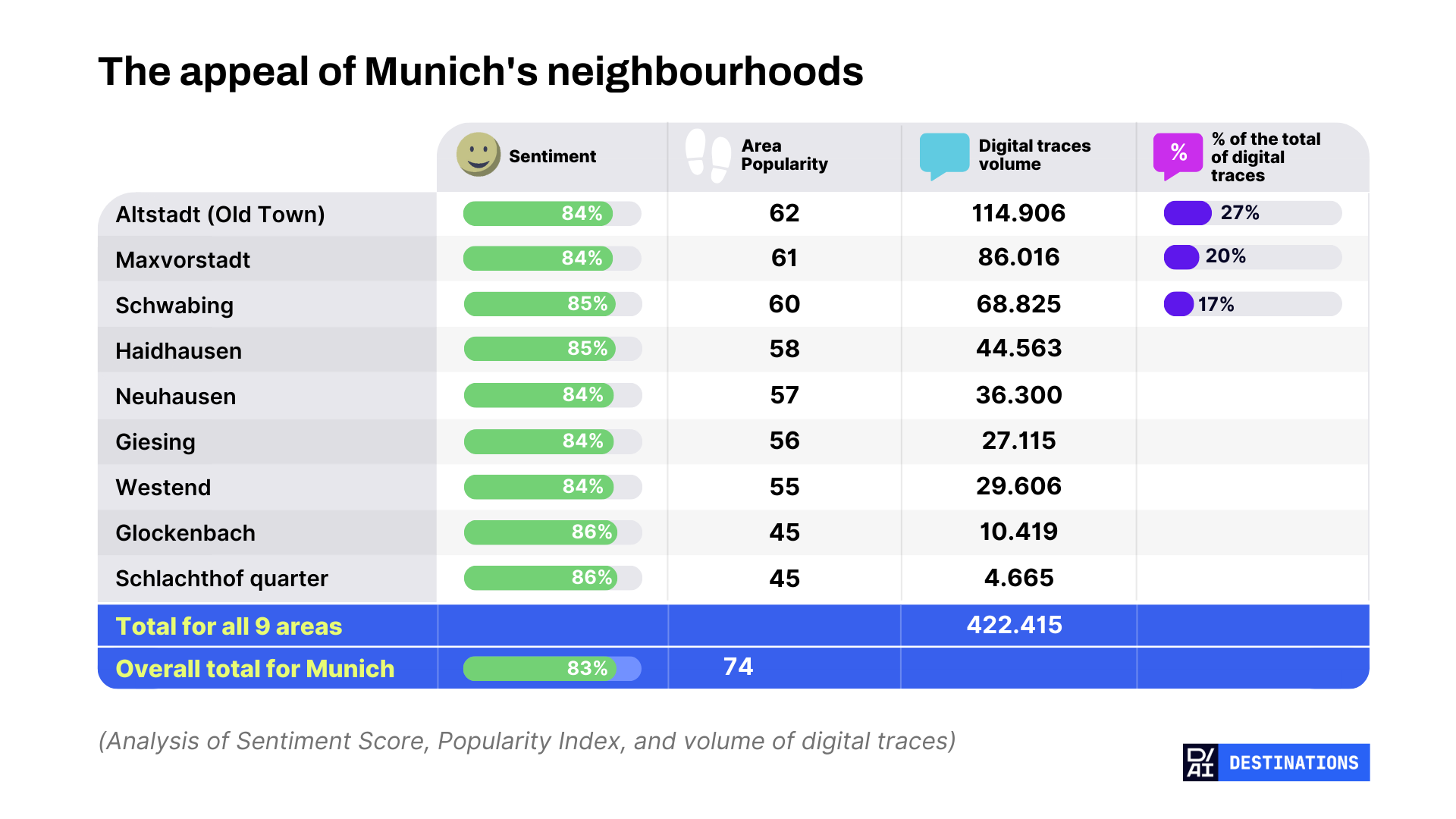

- Altstadt (27%), Maxvorstadt (20%), and Schwabing (17%) together account for the overwhelming majority of digital traces (64%). Their popularity is driven by iconic attractions, museums, and vibrant cultural areas.

- All neighbourhoods have a very high Sentiment Score, ranging from 84 to 86 out of 100. This indicates that, despite the tourist crowds, each area offers visitors a rewarding and varied experience.

- Glockenbach, known for its nightlife, and Schlachthof, an alternative district famous for its murals, have the lowest volume of digital traces but the highest sentiment scores. This suggests that the destination could consider developing offers, initiatives, and events in these areas to create new, unconventional experiences for visitors.

Altstadt, Maxvorstadt, and Schwabing: what makes them stand out?

With the help of D / AI Destinations, we’ve created detailed profiles of each neighbourhood, covering aspects such as digital trace composition, hotel rates, market presence, and the key points of interest that visitors love most.

This analysis provides valuable insights into the unique qualities of each neighbourhood, helping us determine the best ways to promote them internationally, on social media, and on the destination’s website.

To give you a glimpse of our findings, here’s a summary of the analysis of the three most popular neighbourhoods in the city.

Altstadt (Old Town)

Altstadt, the historic centre of Munich, accounts for 27% of the city’s digital traces and hosts the highest concentration of attractions, representing 21% of all points of interest. It’s the most popular area, though its Sentiment Score is slightly lower than that of other areas, a common trend in heavily visited locations.

The real strength of Altstadt lies in its museums and cultural attractions, which boast an exceptional Sentiment Score of 92.2/100.

In terms of tourist segmentation, nearly 75% of visitors are international, with the United States leading, followed by Switzerland, Italy, and the United Kingdom.

Americans are the top international market in this neighbourhood, indicating that they are high-spending visitors who tend to stay in and primarily explore the city centre.

Maxvorstadt

Maxvorstadt accounts for 20% of the digital traces. As a highly touristy area, more than 60% of the points of interest and digital traces are related to restaurants and venues. However, once again, it’s the cultural attractions that draw the most interest, with a sentiment score consistently exceeding 90/100. Among the top five attractions are some of Munich’s most renowned museums, alongside the district’s main square, Königsplatz

62% of visitors to Maxvorstadt are international, particularly from Italy, Austria, Switzerland, and the United Kingdom. Maxvorstadt also sees a higher proportion of solo travellers compared to other neighbourhoods, largely due to the presence of hostels.

Schwabing

Known as the artists’ quarter, Schwabing owes much of its popularity to the beautiful green space of OlympiaPark, the Olympic Park opened in 1972 for the Olympics. Today, people enjoy relaxing there, as well as attending concerts and events.

One of the area’s key attractions is the Sea Life Aquarium, which, while receiving a significant number of reviews, has a Sentiment Score that suggests there’s potential for further improvement (77/100).

Over 50% of tourists in Schwabing are domestic, and among the international visitors, Austrians make up the largest group, followed by the Swiss, Italians, and visitors from the UK.

Neighbourhoods and hotel rates: from the most expensive to the budget-friendly

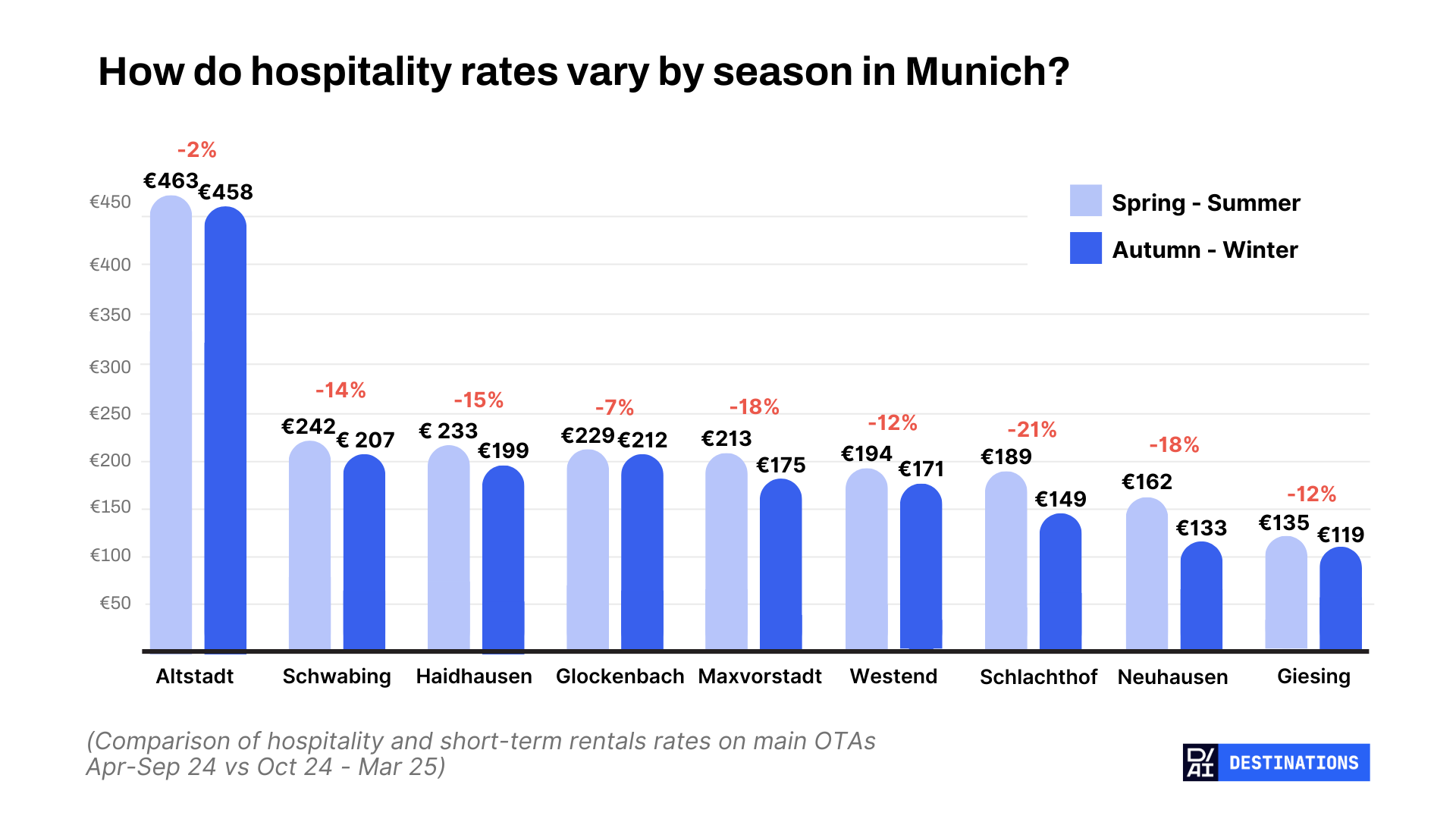

An important distinction to make when it comes to neighbourhoods is related to hotel rates: the cost of hotels and short-term rentals has a significant impact on travellers’ choices. Profiling the cost of each area can help the DMO understand the accommodation preferences of different types of travellers and more clearly define the price sensitivity of each source market.

The data collected in December 2024 clearly highlights the difference in rates listed on OTAs for each area, depending on the time of year.

This analysis shows that summer prices are generally higher, but the extent of seasonal variation varies greatly depending on the neighbourhood and its level of centrality.

The historic centre, Altstadt, and Glockenbach have the smallest variations, as they are in high demand throughout the year. In contrast, there is a significant seasonal fluctuation in Schlachthof, Munich’s ultimate underground neighbourhood, which clearly attracts more tourists only in the summer.

Preferred neighbourhoods of Italians, French, and Poles

Simply Munich is particularly interested in understanding the preferences of Italians, French, and Poles, three emerging markets for the destination.

The data from the analysis of digital trace volume by country of origin reveals significant variations.

French tourist preferences

French reviews are more concentrated in the central and western neighbourhoods. A higher percentage is noted in Westend (3.38% of the total), known for its proximity to Oktoberfest and its multicultural atmosphere.

A good proportion of reviews are also found in Altstadt and Maxvorstadt (2.4%), due to the high presence of museums and cultural attractions.

Glockenbach and Schlachthof, on the other hand, are areas with fewer French visitors.

Italian tourist preferences

Digital traces reveal a strong presence of Italians across all neighbourhoods (3.73% – 6.19%). Reviews are particularly abundant in Giesing (7.90%), a former working-class district in transformation, with an emerging cultural scene that blends Bavarian tradition with trendy new venues and very affordable prices.

It’s interesting to note that reviews related to hospitality make up 45% of the digital content in this area, despite hospitality establishments representing only 3% of the points of interest (POIs). This likely indicates that Italian visitors—due to the challenging economic situation over the past year—prefer Giesing as a base for exploring the city, as it offers better value for money compared to other areas.

Indeed, Giesing has the most affordable hotel rates in the city (119-135 € per night for a double room).

A significant presence is also noted in Schwabing (3.73%), one of the city’s most popular areas for historic cafés and shopping. Here, Italians are the third-largest market by digital trace volume, following Austria and Switzerland.

Polish tourist preferences

The presence of Polish visitors, based on the distribution of reviews, is much lower than that of Italians and French in almost all neighbourhoods.

The only exception is Glockenbach (2.37% of reviews), which offers nightlife and affordable prices.

Together with the lower interest in more expensive areas like Altstadt (only 0.8% of reviews), this may suggest that Polish visitors have a lower spending capacity compared to the French and Italians.

Other key markets

Regarding the other key markets identified by Simply Munich, the analysts at Data Appeal have found:

- Germans represent a significant portion of visitors in nearly all neighbourhoods, with percentages ranging from 25.42% in Altstadt to 49.42% in Neuhausen. As locals, they tend to explore less touristy and more authentic neighbourhoods, such as Neuhausen and Haidhausen.

- Austrians show a more evenly spread presence, with peak percentages in Schwabing (5.98%) and Altstadt (3.78%). This suggests that, in addition to historical and cultural attractions, these visitors also enjoy luxury boutiques and fine dining.

- Swiss visitors are more concentrated in central neighbourhoods like Altstadt (6.17%) and Maxvorstadt (4.25%). This indicates a strong inclination towards luxury tourism, as these areas are home to high-end accommodation and expensive shops.

From solo travellers to families: who visits Munich?

A useful segmentation to consider is based on the type of traveller: families, couples, singles, and groups. What are their behaviours? Which neighbourhoods do they prefer?

- Couples and families are the most common type of visitor in each neighbourhood, usually making up the largest portion of the presence (20-40% of the total).

- Solo travellers tend to focus primarily on Neuhausen and Maxvorstadt. In Neuhausen, solo travellers represent the largest group (31%), surpassing even couples and families, which is a significant difference compared to other areas.

- In Maxvorstadt, the concentration is also notable (22%), which comes as no surprise. The area is rich in galleries and museums and serves as Munich’s student hub, known for its vibrant social scene. Popular spots like Bar Sehnsucht, Café Jasmin, and Augustiner-Keller offer plenty of opportunities to socialise, with lively cafés and beer gardens adding to the charm.

- Groups generally make up 13-16% of the total presence, with a higher concentration in more budget-friendly areas like Giesing and Neuhausen.

Data and markets: exploring Munich’s neighbourhood preferences to craft personalised experiences

The data collected by Data Appeal for Simply Munich highlights how crucial it is for DMOs to use insights into tourist behaviour to create targeted offers and exceptional travel experiences.

From the central Altstadt to emerging areas like Schlachthof, each neighbourhood presents unique opportunities to cater to the preferences of key markets and different types of travellers.

With this detailed level of analysis, DMOs can optimise their promotional strategies and tailor their offerings, enhancing the perceived value of the destination.

Munich is the perfect example of how data can guide more informed decisions, leading to more effective results.