Transform your business into a sustainability leader with AI

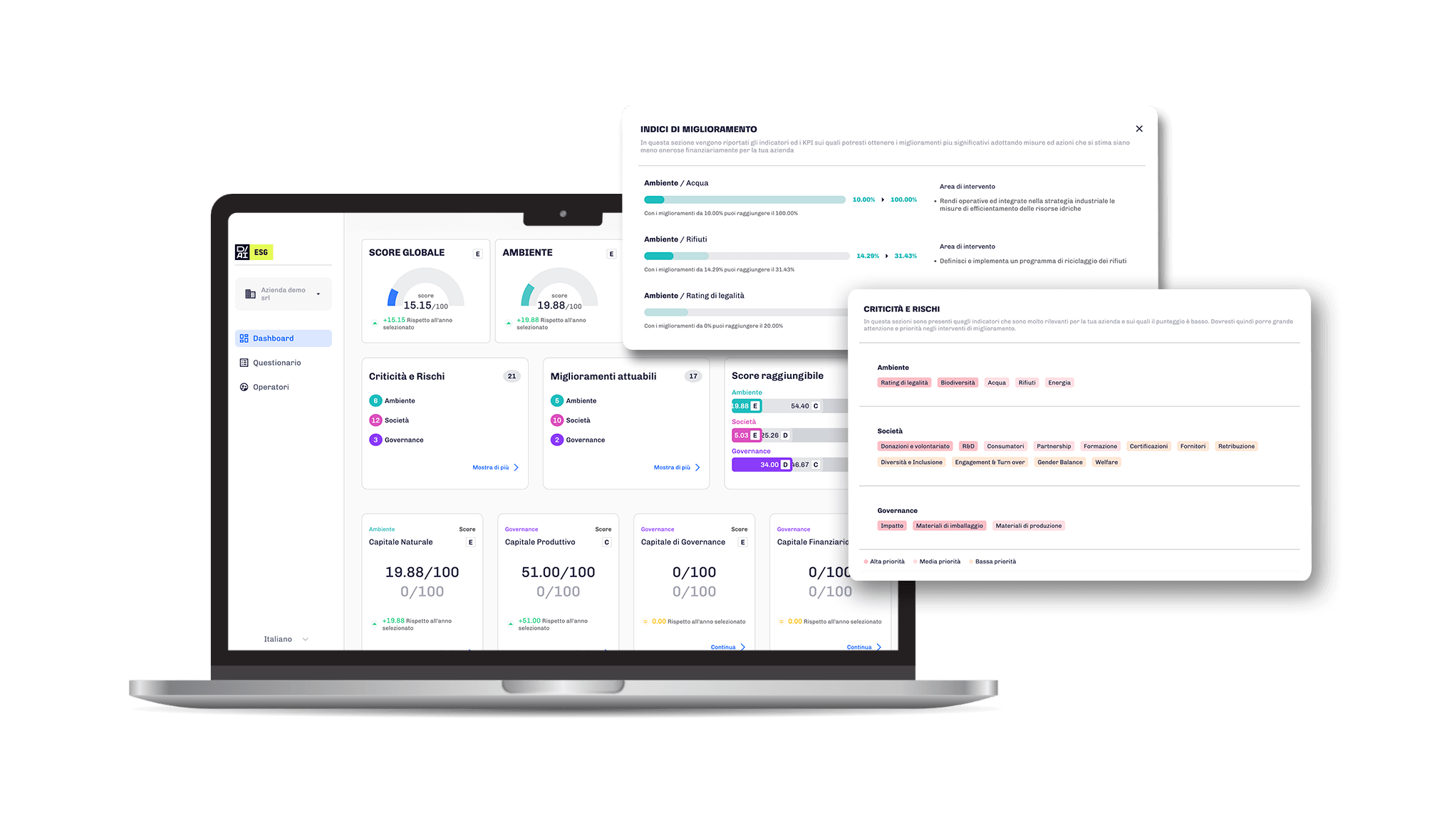

D / AI ESG is the new ESG Scoring platform powered by artificial intelligence, designed to assist in the real-time analysis, verification, and enhancement of sustainability performance for both your business and supply chain.

Evaluate the ESG performance of your company and suppliers, then optimise accordingly!

What can D / AI ESG

do for you?

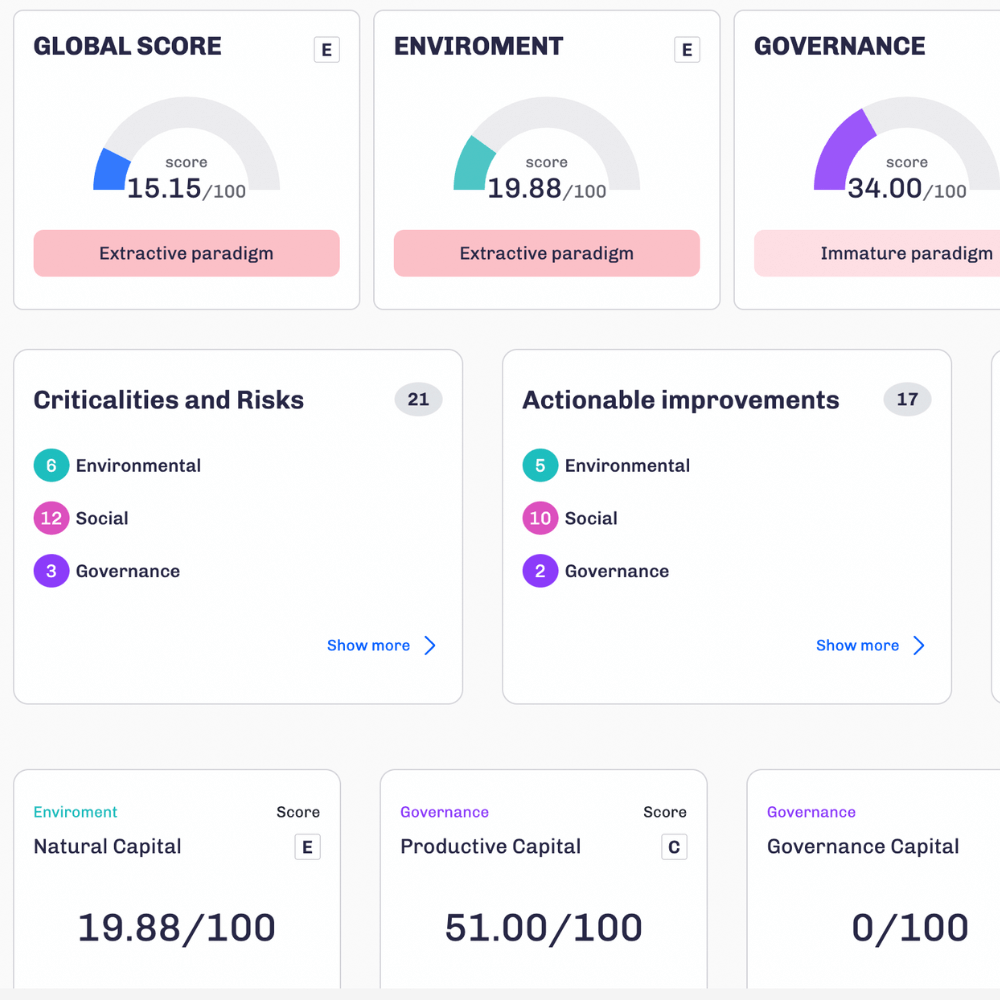

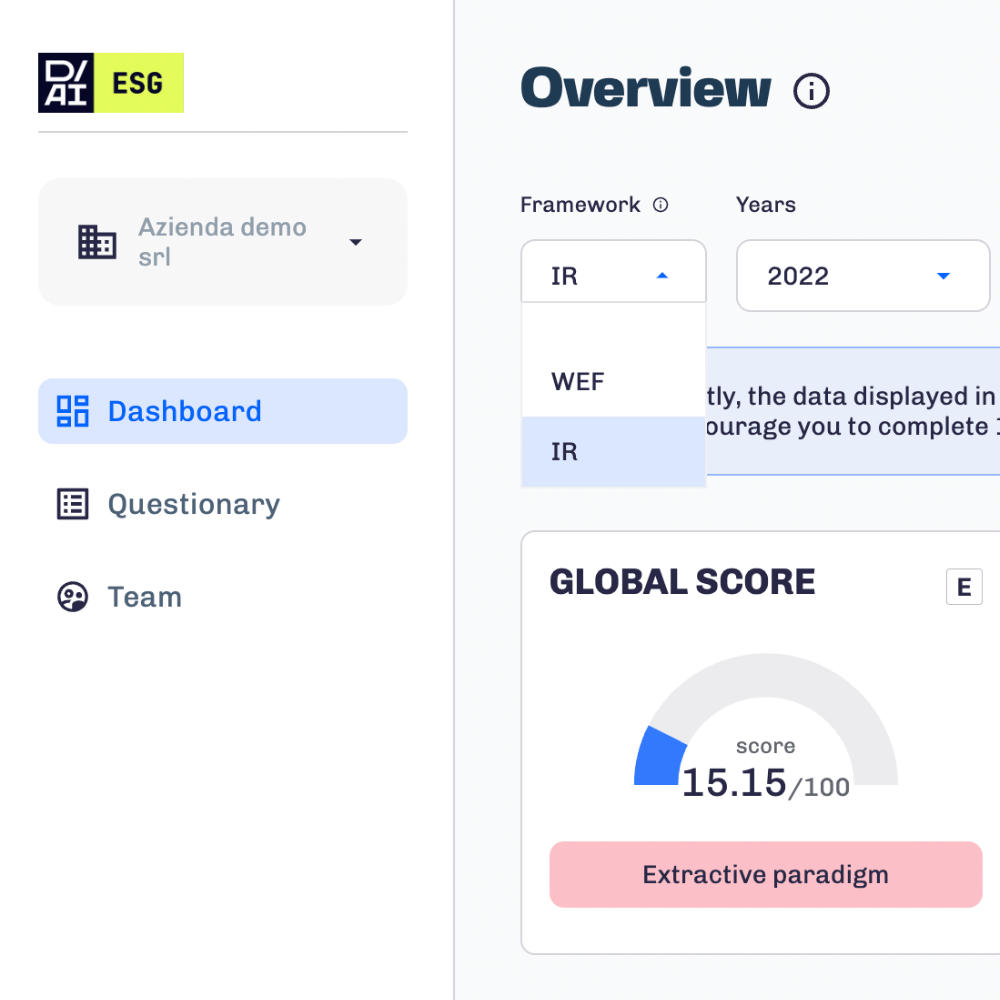

Your evaluation at a glance

Thoroughly assess each aspect of ESG performance.

Compare current performance trends with industry averages.

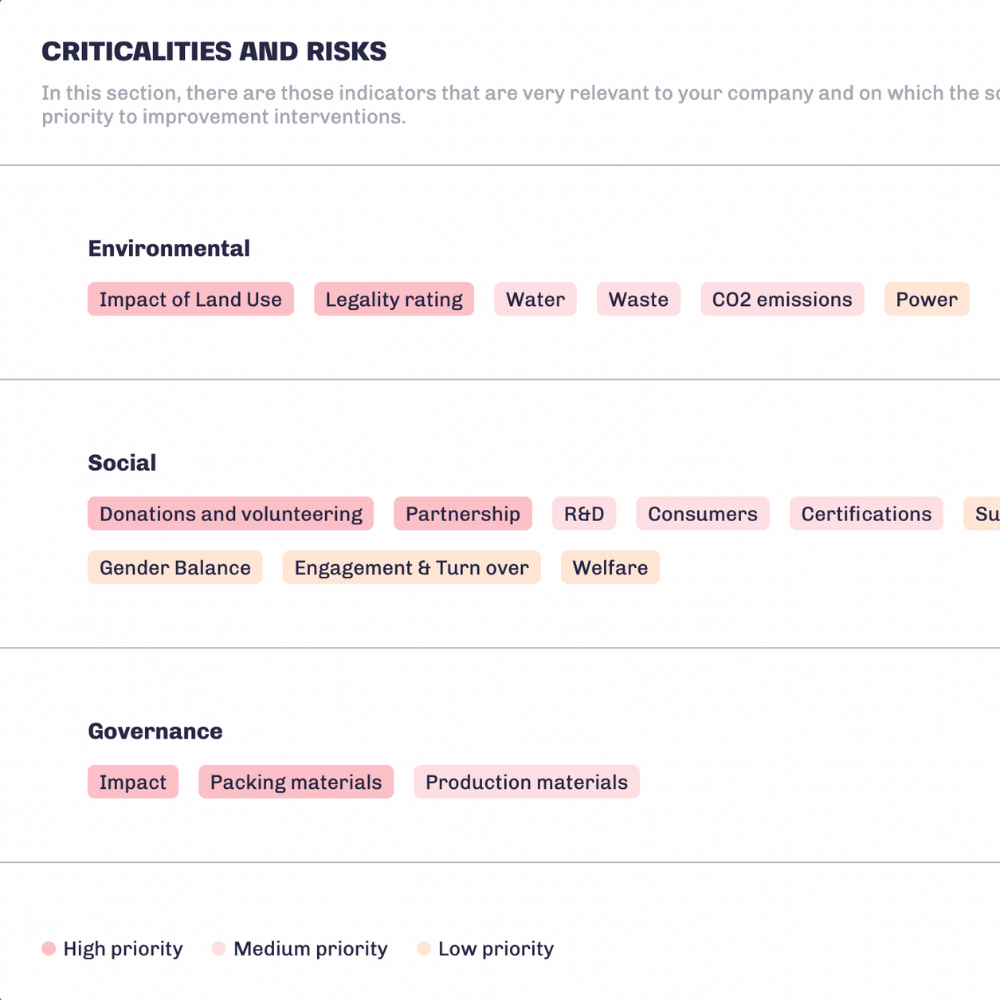

Critical aspects, risks, and recommendations

Pinpoint critical issues and risks, and receive immediate, precise insights on enhancing your performance and the potential growth of your score.

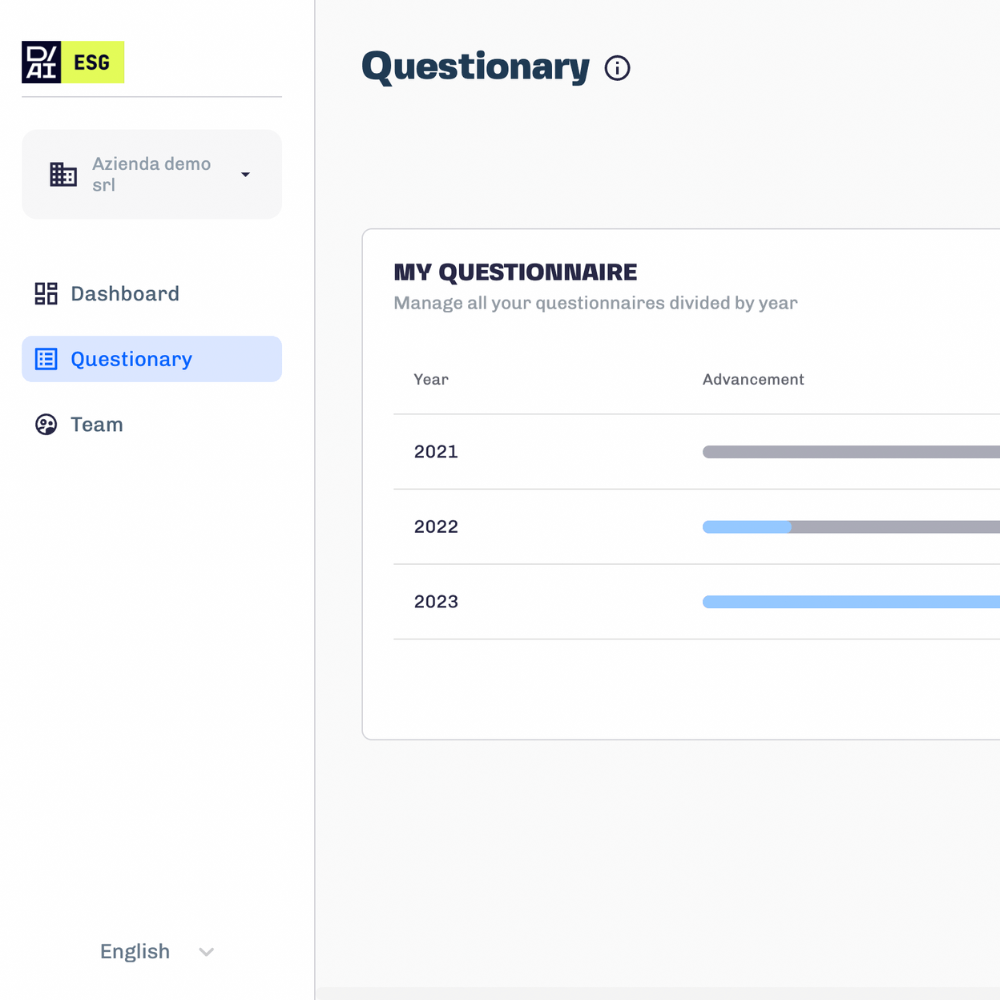

User-friendly interface and artificial intelligence

Input all essential data for score calculation via a simple and intuitive interface, powered by Artificial Intelligence.

Internationally-acknowledged frameworks

View your ESG Score across IR, WEF, GRI, and ESRS frameworks.

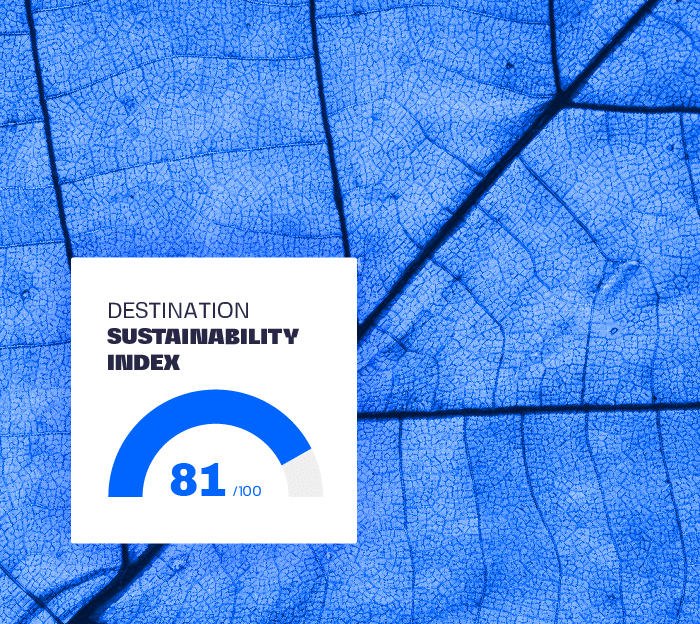

Proprietary KPIs

You have the option to enrich your analysis with Data Appeal’s proprietary indicators, such as the Sentiment Score and the Inclusivity Index.

Automated reports

Download automatically generated reports for sharing with colleagues, clients, and stakeholders.

CUSTOMER STORY

ESG scoring analysis in half the time

“We had an urgent need to assess our ESG performance to bolster our sustainability report and vet our suppliers. The process proved to be straightforward. Consultants had initially estimated it would take twice as long to conduct these analyses independently.”

Massimo V,

CEO of an Italian retail company

Consultants had estimated it would take twice as long