In their latest data analysis, The Data Appeal Company, in partnership with Sojern, reveals an in-depth outlook for summer Italian tourism, including the top European travel trends for the second half of 2021. What will happen in the coming months? Is European travel really on its way to recovery? Will international and transatlantic tourists return?

Across Europe, the tourism industry is beginning the reopening phase with cautious optimism. Hotels, restaurants, museums and beach resorts are launching new, Covid-friendly strategies hoping to soon welcome tourists with open arms while trying to keep up with the always-evolving rules and regulations.

The vaccination campaign is gaining momentum and the number of positive Covid-19 cases is slowly, but steadily decreasing. In Italy, one of the most popular tourism destinations, the Prime Minister has declared the country as a safe destination and will open its borders to foregin tourists in the coming weeks.

Above all, in the wake of the massive vaccination campaign over recent months, American travelers, who have always been one of the largest visitors in Europe – especially to Italy – will be allowed to return this summer. This alone gives many operators in the tourism sector much hope for the upcoming season.

To uncover what European tourism and Italian tourism will look like this summer, The Data Appeal Company, with the support of our partner Sojern, has analyzed a variety of datasets to determine the upcoming travel trends and forecast who will visit Europe this summer, and where they’ll be coming from.

Sojern, the leading digital marketing solutions platform for tourism, analyzes data relating to online travel intentions – in real time. With their Artificial Intelligence technology, Sojern allows its customers to reach the right travelers at the right time with personalized digital campaigns. The data is shared between independent hotels, hotel chains, airlines and tourism portals.

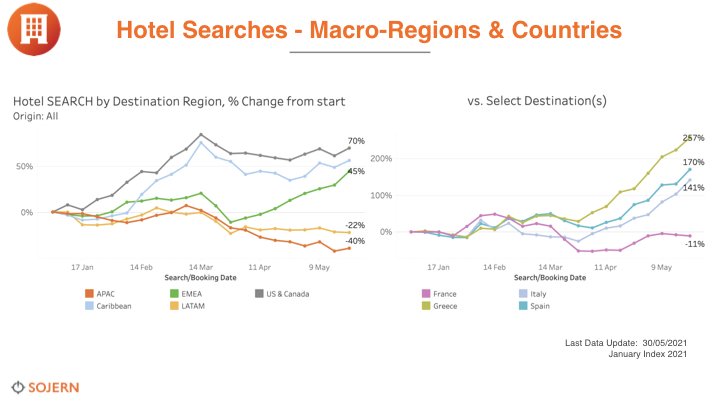

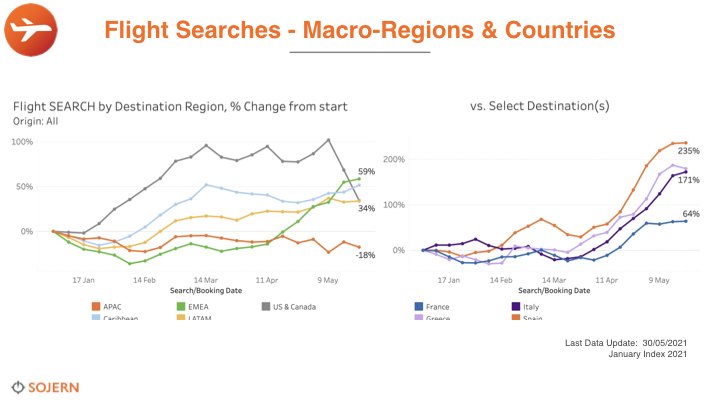

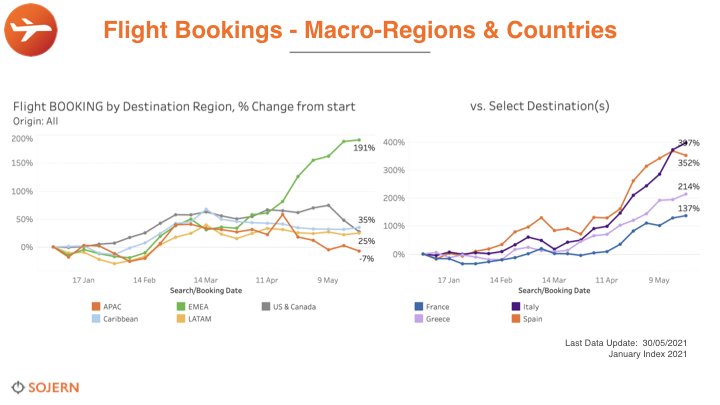

Hotel and flight searches are on the rise across Europe

Already, from the data we have collected and analyzed, very positive trends are emerging. Online searches for hotels and flights to Europe have recorded strong growth compared to the same period last year and suggest that recovery is upon us. We’ve detected signs of strong desire to resume traveling as soon as possible, especially from American, Canadian and Caribbean tourists, but also from the EMEA territory.

The European destinations that are most attracting these travelers are Greece, Spain and Italy. Italy in particular marks a +141% of hotel searches and a + 181% in hotel bookings compared to January 2021.

Flight trends follow a similar pattern to hotels. In Italy, we recorded a 171% increase of flight searches and an almost 400% increase in flight bookings compared to January 2021.

As the graphs reveal, the main sources for the Italian tourism are travelers coming from EMEA and USA. This comes as no surprise as these are the destinations with the highest levels of vaccinations and therefore, confidence and intention to travel.

Italian Tourism: Domestic Travel Is On the Rise

Italians are much more cautious in their travel intentions than foreigners. In fact, the data indicates that this year Italians will mostly spend their holidays within the borders of the beloved boot-shaped nation.

After analyzing travel searches by Italians, there is a surge of domestic hotel and flight searches in April and May. We can expect a strong restart and rebound for Italian tourism, perhaps even better than last year.

In fact, hotel searches and bookings by domestic travelers in Italy increased by +378% and +133% respectively. Searches and bookings carried out by Europeans are also on the rise, although volumes are still low compared to 2019.

Moreover, flight searches and bookings from the Italian domestic market have escalated since January 2021 recording +249% in searches and +598% in bookings.

The Leadership Effect: An administration of confidence for the Italian tourism

“The world wants to travel to Italy, and Italy is ready to welcome back the world. I have no doubt that tourism in our country will re-emerge stronger than before“, declared Mario Draghi, Italy’s Prime Minister at the beginning of May.

The Prime Minister’s statement had an extremely positive effect on the Italian tourism. With just a few words, Draghi inspired the country with his optimistic outlook on the current state of health and border reopening for tourism this summer.

In fact, after examining hotel and flight searches across the top ten major destinations around the world, Italy ranks first. There’s a spike from April to May, especially when looking at the most recent 30 days compared to 60.

Italy is on the rebound as one of the first countries that international tourists intend to visit once borders are open for leisure travel.

Particularly, over the last 30 days, from April to May, hotel hearches by domestic (Italian) travelers increased from +54% to +104%, but don’t rule out foreign travelers. Searches from top European markets to Italy are also on the rise, in particular France, Germany, Switzerland and Belgium.

When examining flights to Europe over the past 30 days, domestically and abroad, Italy shines once again. There’s a very strong increase in searches, especially within Italy (+88%), confirming that domestic travelers will be the most active. However, the most prominent increase in searches, when compared to the previous period, was from Germany and France.

Fig. 7: andamento delle ricerche voli verso l’Italia per paese di provenienza negli ultimi 7 giorni, 14 giorni e 30 giorni rispetto agli ultimi 14, 28 e 60 giorni dal 3 gennaio al 31 maggio – fonte: Sojern.

What’s the perception of Italy on a global level?

Beyond the analysis of online searches, we know that most of this summer’s travel will take place to and from the countries ahead of the vaccination curve (i.e. USA, Greece, Israel, etc.). Italy is among the top destinations in the minds and hearts of travelers, and as we’ve seen, travel intentions to the Bel Paese are leaps and bounds what they were in 2020.

But how do we exactly pinpoint the real perception of Italy?

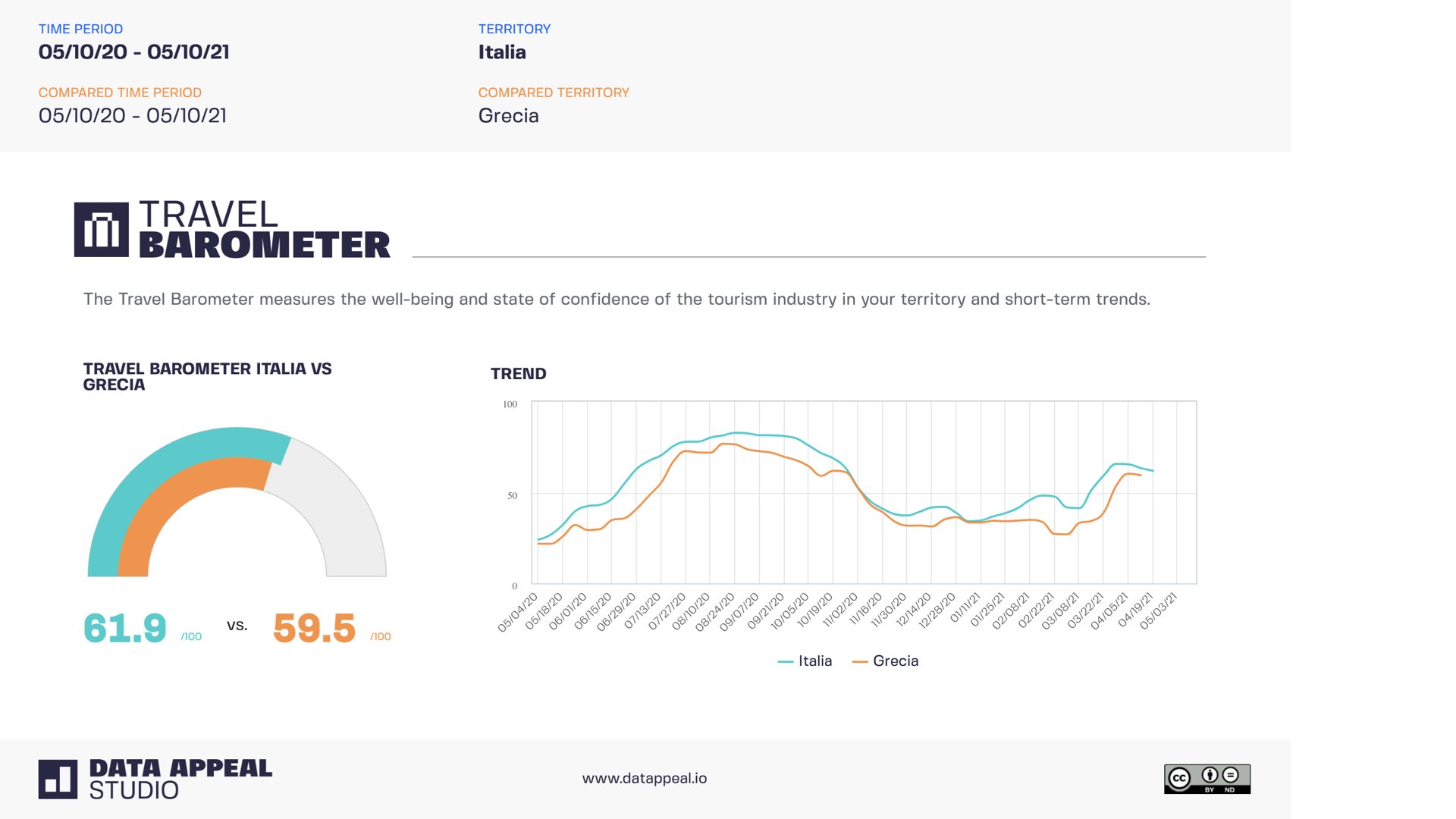

To better understand Italian tourism and Italy’s positioning in the eyes of both domestic and international tourists, The Data Appeal Company analyzed the perception of the country based on three proprietary indexes, capable of measuring different aspects of the destination. For this analysis, Italy was compared against Greece, one of their historical competitors in the Mediterranean.

1 – Sentiment

The Sentiment Score indicates the quality of the traveler experience and measures the level of satisfaction about a service, product, brand or territory.

As the graph below reveals, the Sentiment of Italy records a strongly positive value (88.6), and is only slightly lower than that of Greece (89.6).

The Sentiment trend between May 2020 and May 2021 shows a decline as it approaches the summer months. Historically, this occurs because a high saturation of a destination is inversely proportional to the level of satisfaction expressed by visitors. More crowds, minimal air conditioning and longer waiting times and lines are the main reasons to blame.

Together with the Sentiment, obtained by semantically analyzing online content collected from social networks, review sites, portals and forums, Data Appeal has also uncovered the most discussed topics.

The most popular topics include staff, food, rooms, atmosphere, and cleanliness. In particular, the issues of safety and sanitation emerge for the first time among the top trends, which until a year ago was nearly non-existent.

This trend reveals that travelers place a lot of weight and pay close attention to how the Covid-19 crisis will impact their experience. Key themes in online content now include spacing/distancing, masks and the availability of hand sanitizer.

2 – Trust & Confidence

The Travel Barometer is an indicator that measures the wellbeing of any destination’s tourism industry. It also encompasses the short-term confidence to travel to that destination.

When Italy is confronted against Greece, the confidence of travelers about Italy (61.9) is higher than that of Greece (59.5). Although Italy is behind in the percentage of vaccinations, tourists still show a willingness to travel. Moreover, there is a strong correlation with the explosion of flight and hotel searches to Italy.

3 – Safety & Sanitation

As anticipated, safety and sanitation have emerged as some of the most discussed issues – especially in relation to tourism.

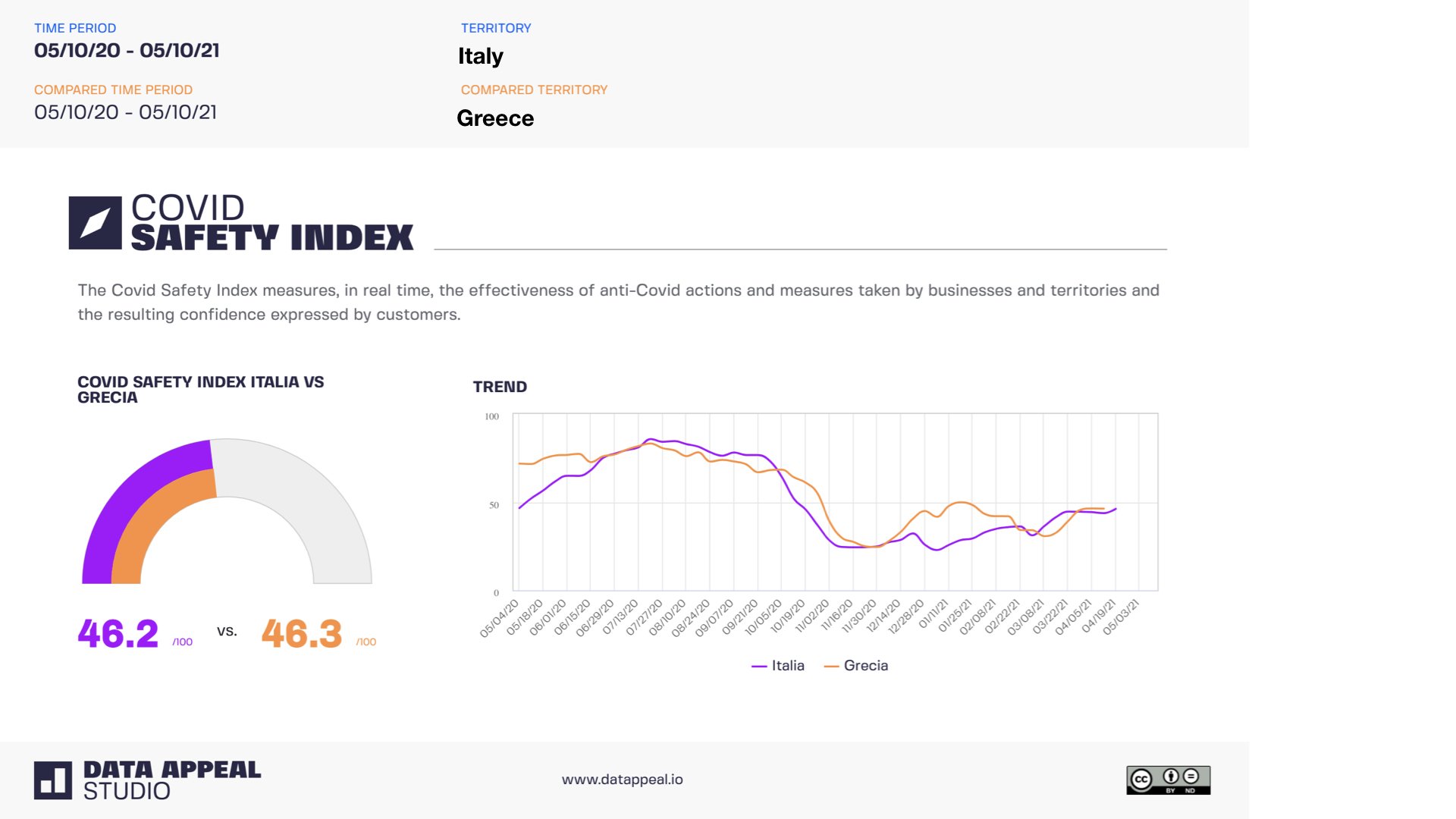

The Covid Safety Index was designed to precisely measure how territories and operators are implementing anti-contagion actions, and conversely, how people perceive these actions.

In this analysis, both Italy and Greece have a relatively moderate Covid Safety Index, around 46, but there are still many margins for improvement. The CSI scores of both destinations, according to the latest Data Appeal analysis, is in line with the rest of Europe.

Summer Tourism 2021: Cautiously optimistic

After cross-analyzing flight and hotel searches, thanks to our partner Sojern, with sentiment and traveler perception data, we have uncovered some very positive data-driven insights. There’s no doubt that tourists intend to return as soon as possible to the Mediterranean countries, especially Italy and Greece.

Starting in mid-June, arrivals and bookings are expected to steadily grow over the summer – both from the domestic and international markets. The short-haul market is beginning to pick up with increasing vacations and rapid tests. Over the next few months, growth is also expected from the North American markets, and we can expect the Asian and South Pacific markets to follow thereafter.

“It is always comforting to see many of our positive indicators, both in terms of travel intentions (searches) and bookings to Europe and especially Italy. But the pandemic provided the travel industry with a great lesson. We must learn to live with an ever-changing situation. It’s essential to make decisions based on real data analyses and invest in digital marketing to measure the concrete impact of your investments“, shares Luca Romozzi, Commercial Director, Destinations of Sojern.

“When evaluating price and occupancy trends on the major OTAs, average prices of accommodations are quite stable, but many rely on last-minute bookings or refundable options. The Italian tourism industry needs to capitalize on the interest and intent of tourists, designing strategic and effective campaigns that promote open borders and ensure safety. ” concludes Mirko Lalli, CEO and Founder of Data Appeal.

Watch the video:

https://youtu.be/zgmWK_mnz3M