For Taylor Swift fans in Europe, summer 2024 promises to be anything but cruel, as the beloved American pop singer is back touring in Europe after a 6-year break.

After its immensely successful run through the United States in 2023, the Taylor Swift Eras Tour is now ready to enchant European audiences, with a staggering 48 dates announced so far, spread across the continent.

While Swifties’ excitement is evidently palpable, it’s not confined to just the singer’s fanbase. Destinations all over Europe, where the Eras Tour concerts are set to take place, are equally eager for the events.

European cities aspire to mirror the tremendous success experienced by the tour in locations that have already hosted concerts, primarily situated in the US as of the current writing.

Events, such as concerts, serve as magnets for boosting a destination’s popularity and destination marketing, that is, the strategy or approach used by Destination Management Organisations (DMOs) to promote and advertise their destination to attract visitors, tourists, or attendees to events, and boost the local economy as a result.

It’s a win-win situation, as attendees enjoy the event and the destination’s offerings, while local businesses see an increase in their revenue and growth.

Similarly, the buzz generated during events amplifies through word of mouth, social media, and media coverage, effectively promoting the destination to a broader audience.

And while this holds true for every event, consider the influence of a concert tour projected to generate nearly $5 billion in consumer spending in the United States alone. This tour, none other than the pioneering Eras Tour by Taylor Swift, is setting groundbreaking records while also shattering records in host cities, leaving an indelible mark on the local economy and culture.

Destination marketing (Taylor’s Version)

It comes to no surprise that destinations that have hosted the Eras concerts so far this year have implemented several marketing strategies to promote their destination by leveraging the concerts taking place.

Destinations are in fact going a long way to welcome the artist and Swifties. For instance:

- The mayor of Pittsburgh briefly changed the city name to “Swiftsburgh” during the tour stop in town.

- In Nashville, the Cumberland River Pedestrian Bridge was lit up with purple lights to coincide with the announcement of the artist’s “Speak Now (Taylor’s Version)” release during her concert at Nissan Stadium, symbolising the album’s associated colour.

- Houston illuminated its city hall in lavender, paying homage to Swift’s song “Lavender Haze” and the colour purple linked to the “Speak Now” album.

- Philadelphia unveiled a mural on South Street featuring the artist on South Street, commemorating Swift’s three consecutive sold-out concerts.

🪻Houston City Hall to illuminate

— TaylorSwiftPage (@swiftpage13) April 22, 2023

'Lavender Haze' for Taylor Swift all weekend pic.twitter.com/5vg92jgvEo

The mentioned initiatives provide a glimpse into the diverse and creative strategies destinations use for marketing. They emphasise that utilising creativity and distinct methods, especially in conjunction with significant events, remains an effective approach.

The undeniable economic impact of Taylor Swift and her Eras Tour emphasises the lasting influence and the enduring advantage of utilising such major events to boost local communities and businesses.

According to statistics quoted by the U.S. Travel Association:

- Swift fans during the U.S. leg of the tour have exceeded conventional spending norms by averaging $1,300 on local expenditures, encompassing travel, lodging, dining, merchandise, and more.

- The two concerts in Pittsburgh led to $46 million in direct spending. Notably, hotel occupancy during that specific weekend soared to an impressive 95%, marking the highest post-pandemic weekend occupancy and the second-highest recorded for a weekend.

- Los Angeles, being the host of six shows, witnessed a significant economic impact, totalling $320 million, while also generating 3,300 job opportunities.

In Denver, the concerts contributed an estimated $140 million to the state’s GDP through visitor spending, showcasing the economic prowess of such events.

Similarly, according to statistics our partners, PredictHQ, issued on their blog, the Inglewood, California stop of the Eras Tour on August 9, 2023 was expected to generate an impressive revenue of $10,842,293.

Taylor Swift tour across Europe: Anticipated impact in London, Milan, and Amsterdam

We’ve seen the tremendous success the Eras tour has had already internationally. But what about Europe?

What can European destinations expect in terms of impact?

To answer this question, we consulted our all-in-one destination marketing platform, D / AI Destinations through which destinations can predict visitor arrivals, analyse and compare present and anticipated arrival figures, assess accommodation rates and occupancy levels, gauge visitor sentiment and experiences, and obtain insights from web monitoring.

As an illustration, we focused on three prominent European host cities: Milan, Amsterdam, and London.

Within each city, we evaluated projected visitor numbers, taking into account incoming passengers via predicted arrivals (booked through GDS, supplied by our partner, Travelport), passenger behaviour and preferences according to origin, and the average Online Travel Agency (OTA) rates.

Additionally, we compared these elements to their counterparts from the preceding week, as well to the same dates in the previous year, to detect any price variations and forecast the potential influence of Taylor Swift and her concerts on these cities.

Milan

Concert dates: 13 and 14 July 2024

Flights

Passenger distribution on flights to Milan during the concert week vs. the previous year – source GDS – D / AI Destinations

When compared to the same period last year, long-haul travel is predicted to rise during the Eras Tour dates, especially among Americans who are expected to make up 25.5% of travellers, up from 10.4% in the same week of 2023. This trend is also seen in short-distance travel, notably from Germany.

This upswing may also signify more concert attendees who proactively booked their flights upon securing their concert tickets.

Likewise, the travellers’ countries of origin tell a compelling story. While these five markets are consistently among the top markets for Italy, the uptick could be attributed to individuals flying in to combine a vacation with the concert experience.

However, it’s worth noting that these markets primarily consist of early planners, so the data may fluctuate as the concert dates draw nearer, with an influx of visitors who tend to book on shorter notice.

Passenger distribution on flights to Milan during the concert week vs. the previous week – source GDS – D / AI Destinations

Anticipated growth in long-haul markets is notable in the week leading up to the event, particularly from Australians, constituting 13.4% of the passenger distribution. This surpasses the percentage seen during the concert week itself (5.3%).

Once more, a significant portion of those who have already made travel arrangements to Milan for the concert may be incorporating the event into their vacation plans, particularly among international visitors.

Milan, a consistent event hub in Italy and Europe, might also be attracting visitors due to various events occurring simultaneously.

Additionally, it’s worth noting that July is already peak season in Italy, and the surge in visitors is also attributed to those traveling to Italy, given Milan’s significance as a major international airport for travelers heading to popular destinations such as Lake Como and Lake Garda.

Conversely, Italian passengers are expected to notably increase in the days nearing the event. This can be attributed to the shorter travel time and easier accessibility with more available flights to and from Milan. Given that this is the artist’s only tour date in Italy, Italians from different regions tend to travel to Milan for the concert.

OTA rates

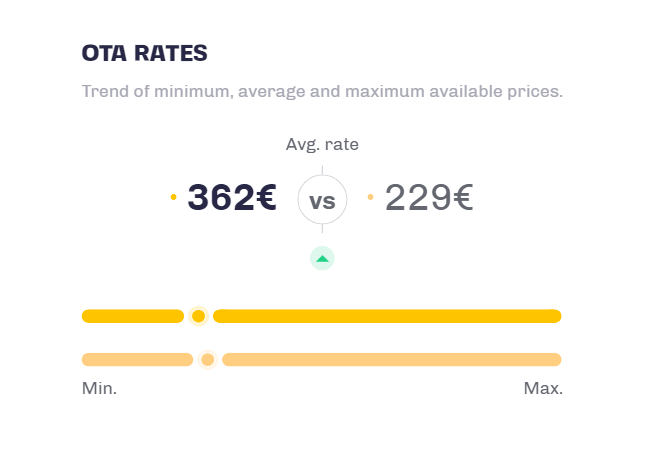

(Average accommodation rates recorded on OTAs vs. the same dates in 2023 – source D / AI Destinations)

The average rate for 2024 is elevated compared to the same week in 2023, reaching €362, a notable increase of €133, as evident from the trend.

These hikes are in line with the typical year-on-year price increments and travel alterations observed compared to the previous year, but may also indicate a higher demand from concert attendees.

Specifically, during the event week, the average rate is higher at €362 compared to €322 in the week before, marking a €40 increase, as illustrated by the trend.

Amsterdam

Concert dates: 4, 5, 6 July 2024

Flights

Passenger distribution on flights to Amsterdam during the concert week vs. the same week in 2023 – source GDS – D / AI Destinations

Long-distance travel markets are projected to show growth compared to the corresponding period last year, particularly in the case of American travellers, constituting 50% of the passenger distribution, a significant rise from the 14.1% recorded in the same week of 2023.

The same upward trend applies to Canada (10.4%), and Australia (9.3%). On the contrary, the United Kingdom records a reduced distribution compared to 2023.

Similarly to Milan, Amsterdam is a European travel hub especially for international flights, so this increase may be attributed to a myriad of factors — but we can definitely assume Swift’s concert is a major attractor for visitors during these dates.

Regarding bookings in the week leading up to the concerts, there’s an expected surge in reservations from the United States and Australia, so far making up 51.4% and 11.7% of the passenger distribution, respectively. This exceeds the percentage observed during the concert week. On the other hand, visitors from Canada increase notably primarily in the days approaching the event.

Passenger distribution on flights to Amsterdam during the concert week vs. the previous week – source GDS – D / AI Destinations

OTA rates

(Average accommodation rates recorded on OTAs vs. the same dates in 2023 – source D / AI Destinations)

The average rate is higher in 2024 compared to the same week of 2023, reaching €431 – €149 more – as we can see also from the trend.

The average rate is higher during the week of the event compared to the week before, reaching €431 compared to €347 – €84 more.

London

Concert dates: 21, 22, 23 June 2024

Flights

Passenger distribution on flights to London during the concert week vs. the same week in 2023 – source GDS – D / AI Destinations

Anticipated growth is foreseen in the long-haul markets, notably in the case of U.S. visitors, constituting 23.1% of the passenger distribution, as opposed to the 18.6% recorded in the same week of 2023. This trend is also observed for the Australian market (14.2%). Furthermore, short-haul markets like Germany (10.4%), Italy (8.0%), and Norway (4.7%) are expected to see a similar increase.

Passenger distribution on flights to London during the concert week vs. the previous week – source GDS – D / AI Destinations

In the lead-up to the event, the number of travellers from Australia and Germany are projected to see an increase, comprising 15.3% and 13.0% of the passenger distribution, respectively—surpassing the percentages noted during the week of the concerts. On the other hand, travellers from the United States, Italy, and Norway are expected to increase primarily in the days approaching the event.

OTA rates

(Average accommodation rates recorded on OTAs vs. the same dates in 2023 – source D / AI Destinations)

In 2024, the average rate is higher compared to the same week in 2023, reaching £390, which is an increase of £28, as evident from the observed trend.

Concert dates: 15, 16, 17 August 2024

Flights

Passenger distribution on flights to London during the concert week vs. the same week in 2023 – source GDS – D / AI Destinations

Short-haul travel is expected to increase, notably for German travellers, who make up 27.3% of passengers compared to 3.7% in the same week of 2023. This trend is also seen in Denmark (14.4%), Sweden (5.9%), and Australia (7.0%). However, the United States had a higher distribution in 2023 — although it’s important to recognise that these figures are subject to change as there is still a significant window for booking

Passenger distribution on flights to London during the concert week vs. the previous week – source GDS – D / AI Destinations

Australia and Sweden are anticipated to see an increase starting from one week before the event, making up 8.4% and 6.7% of the passenger distribution, respectively. These percentages are expected to surpass those reached during the week of the concerts.

In a similar pattern, the United States also registers a higher distribution in the week preceding the event, although lower than in 2023. On the other hand, Germany and Denmark mainly experience an increase in the days leading up to the event.

OTA rates

(Average accommodation rates recorded on OTAs vs. the same dates in 2023 – source D / AI Destinations)

In 2024, the average rate is higher than the same week in 2023, reaching £339, which is an increase of £62, as evident from the observed trend.

The average rate during the event week is higher, reaching £339 compared to the £325 from the week prior—an increase of £14, as indicated by the trend so far.

Analysis conclusions

The significant increase in bookings observed in all three cities studied, both in comparison to the preceding week and the same period the previous year, suggests several contributing factors.

The substantial increase in USA, Canadians and Australians observed in all three cities can definitely be linked to the end of Covid-19 emergency and a renewed desire for travel. Similarly, considering these international markets are consistently top choices for travellers from these countries, it’s possible that some visitors may have pre-planned their vacations, which may not exclusively revolve around the concert.

Additionally, heightened marketing efforts and improved accessibility due to increased flight options and enhanced transportation infrastructure may also be influencing the overall surge in bookings.

Some attendees might have faced challenges securing a concert ticket in their own country or city, prompting them to travel for the event.

Especially international tourists may choose to travel to Europe for the concert experience and also take advantage of more affordable ticket prices during the European tour, which offers more value for their money by providing them with a holiday experience alongside the event.

Similarly, the concurrent rise in OTA rates during both the week before and compared to the previous year could be indicative of increased demand and a willingness to pay higher prices for accommodations around the concert dates.

This could be attributed to a combination of factors such as high demand for lodging due to the influx of concert-goers and general tourists during the concert period, possibly coupled with the seasonal popularity of these cities during that time of the year.

It’s important to acknowledge that while these factors contribute to the surge in bookings and rates, the undeniable international success and influence of the concert cannot be overlooked.

The anticipation and excitement surrounding the concert are likely major catalysts for the increased interest and demand, as fans from various countries are likely planning their trips to coincide with the event.

However, confirming the direct impact of the concert on bookings and rates will require observation and analysis both closer to the event, as well as once the concerts have taken place.

Best practices for leveraging concerts for destination growth

Both fans and non-fans can draw inspiration from the destination marketing strategies implemented by locations that have hosted Taylor Swift’s concerts.

In short, concerts can boost tourism, increase bookings, have positive economic and lodging effects, attract international interest, enhance cultural exchange, maximise overall event impact, draw other organisers, and build an audience for future events.

Ultimately today’s music scene will invariably—almost always—feature artists seeking perfect locations to stage their performances, with eager audiences ready to attend.

The responsibility lies with DMOs and similar destination-focused entities to understand which of these opportunities to seize.

It’s about leveraging these concerts to propel their destination forward, fostering growth, and maximising the potential for economic and cultural advancement.

The following are the key best practices destinations can follow to boost their destination’s growth using concerts:

1. Strategic planning

Strategic planning is fundamental to event success. Anticipating and addressing potential bottlenecks through careful, proactive planning is key.

It encompasses defining event goals, understanding the audience, organising logistics, and preparing contingency strategies. This early preparation ensures smooth execution, minimises disruptions, and optimises resource allocation.

Effective collaboration among stakeholders is facilitated, aligning all efforts with the event’s vision. Ultimately, a well-crafted strategy is the foundation for a memorable and seamless event experience, leaving a lasting impact.

2. Effective digital marketing

Taylor Swift concerts have showcased the power of effective digital marketing. Social media platforms like Instagram and TikTok played a huge role in reaching her audience, especially the younger demographic.

Nashville’s marketing strategies are a great example. They effectively utilised marketing strategies that not only showcased the concerts but also emphasised the city’s iconic landmarks, generating widespread sharing of videos and photos of the bridge by fans and news outlets. This dual approach leverages the broad reach of digital platforms to engage a wider audience while also showcasing the host city.

3. Enhancing infrastructure

Improving infrastructure is crucial. Hosting exceptional events is naturally laudable, but a good reputation for organising ensures a smooth experience for everyone — locals and visitors alike.

This not only makes the destination more attractive but also encourages future investments, contributing to ongoing growth and success.

4. Attendee experience enhancement

Enhancing the experience for attendees is paramount. Ensuring they have a memorable and seamless time during the event should be a top priority.

By focusing on providing excellent services, comfortable facilities, engaging activities, and clear information, event organisers can leave a positive and lasting impression.

A well-crafted attendee experience not only fosters satisfaction but also encourages repeat attendance, word-of-mouth recommendations, and a favourable reputation for both the event and the destination.

5. Event data analysis

Data analysis plays a critical role before and after every event.

Beforehand, it helps all stakeholders understand what attendees prefer (and give importance to), to tailor the event to their expectations. By examining past event trends, both in your destination, as well as competing destinations, they can make informed choices to ensure the event aligns with attendees’ desires.

Similarly, after the event, data analysis provides insights into how the event performed, through attendee feedback and engagement data to figure out what worked well and what could be improved.

This vital information guides destinations in refining future events, making them better and more satisfying for attendees.

By offering this crucial data, DMOs empower local operators to refine their strategies and services, ultimately enriching the face-to-face experience for visitors:

- Hotels can optimise their pricing and accommodations

- Restaurants can tailor their menus and staffing

- Retailers can plan promotions and stock accordingly.

This strategic alignment ensures that the local businesses are well-prepared to cater to the specific needs and preferences of event attendees, maximising their satisfaction and likelihood of return visits.

Forecast, compare, strategise with data insights

Incorporating data analysis into event planning isn’t just a trend; it’s a smart strategy that significantly boosts the success and impact of our events.

Data Appeal’s D / AI Destinations streamlines event planning through comprehensive data analysis.

With our all-in-one destination marketing and management platform, you can ensure you’re always one step ahead of your competitors.

In just one user-friendly platform, you’ll gain access to arrival forecasts, visitor demographics, visitor interests and preferences. You can also listen to what they think about your destination through social listening and brand monitoring — all of which can help you strategically plan your next move.

All this information, and more, can be benchmarked against other destinations, ensuring you maintain a competitive edge.

Ready to enter your data-driven era?

Reach out to our sales team now to learn more about our solutions, and how we can help elevate and keep your destination to the top of the charts.