Smart Lending: Alternative Data for Faster Credit Underwriting & Risk Mitigation

What is Smart Lending and how is it benefiting banks and SMEs alike?

There’s an inevitable transformation taking place and it’s enhancing commercial credit underwriting and risk management assessment for financial institutions.

In their latest eBook, The Data Appeal Company highlights the advantages of alternative data for the finance industry, accompanied by an introduction by the Fintech & Insurtech Observatory of the Milan Polytechnic Institute.

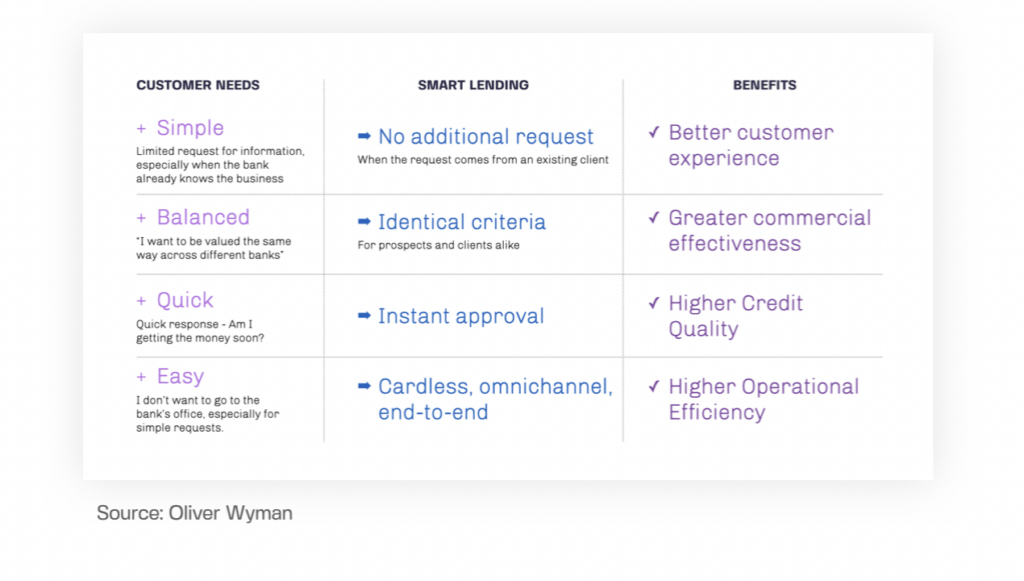

Smart Lending: Lean, fast and simple

For small and medium-sized businesses (SMEs), lengthy loan applications and piles of documents may soon become a distant memory.

In fact, more and more banks have begun to use Alternative Data and online reputation analysis to make the commercial credit underwriting and risk management assessment processes more accurate and efficient.

This phenomenon has been named Smart Lending because it’s lean, fast and simple for businesses, yet also safe and seamless for banks.

Download the eBook for free

Subscribe to our newsletter to receive the eBook:

The Data Appeal Company

The Data Appeal Company leverages data to accelerate progress towards a more sustainable, fair, and inclusive world.

Our dashboards and Location & Marketing Intelligence datasets support global organisations across all industries to make more strategic decisions, improve their marketing activities and grow internationally.

Trusted by