Italy has long been one of Europe’s most popular destinations, attracting visitors from around the world.

However, the story of Italian tourism goes beyond the Colosseum, Venice’s canals, or sun-soaked piazzas.

Travellers’ expectations are changing, new trends are emerging, and the ways people experience the country are evolving in ways that go far beyond the classic landmarks.

So what do these changes actually look like on the ground?

Based on an extensive analysis of 29.5 million digital traces from September 2024 to August 2025, covering 772,800 points of interest across accommodation, attractions, dining, and more, a fascinating picture emerges—one of evolution, diversification, and deepening personal connections. These insights are drawn from D / AI Destinations, the comprehensive destination marketing and management platform, in collaboration with Mabrian, a Data Appeal company. All the following insights are taken from our annual comprehensive report, All Italian Data 2025, where you can explore the following insights and more.

Here are some of the most significant insights reshaping how we understand Italian tourism today.

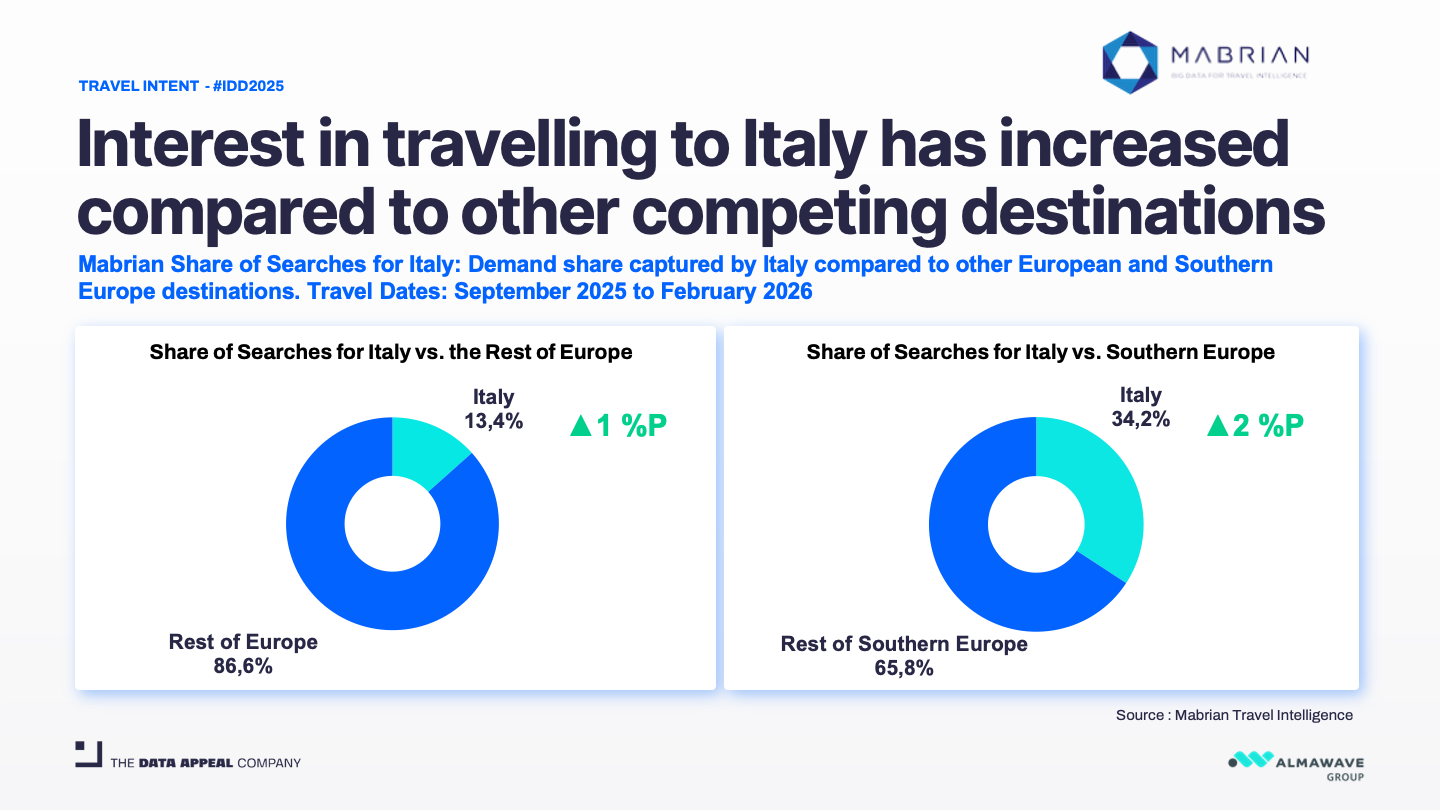

1. Italy represents more than one third of Southern Europe travel searches

Italy is strengthening its lead in European tourism, now accounting for 34.2% of all travel searches for Southern Europe—up 2 percentage points from last year. This marks a notable gain in market share amid strong competition from Spain, Greece, and Portugal.

Perhaps most notably, the shoulder season is gaining serious momentum. Travellers are increasingly spreading their visits beyond the traditional summer crush, diversifying throughout spring, fall, and even winter months. This shift suggests a maturing tourism market where visitors prioritise authentic experiences and manageable crowds over peak-season cachets.

Perhaps most notably, the shoulder season is gaining serious momentum. Travellers are increasingly spreading their visits beyond the traditional summer crush, diversifying throughout spring, fall, and even winter months. This shift suggests a maturing tourism market where visitors prioritise authentic experiences and manageable crowds over peak-season cachets.

The data reveals Italy successfully evolving from a summer-centric destination to a year-round proposition.

The data reveals Italy successfully evolving from a summer-centric destination to a year-round proposition.

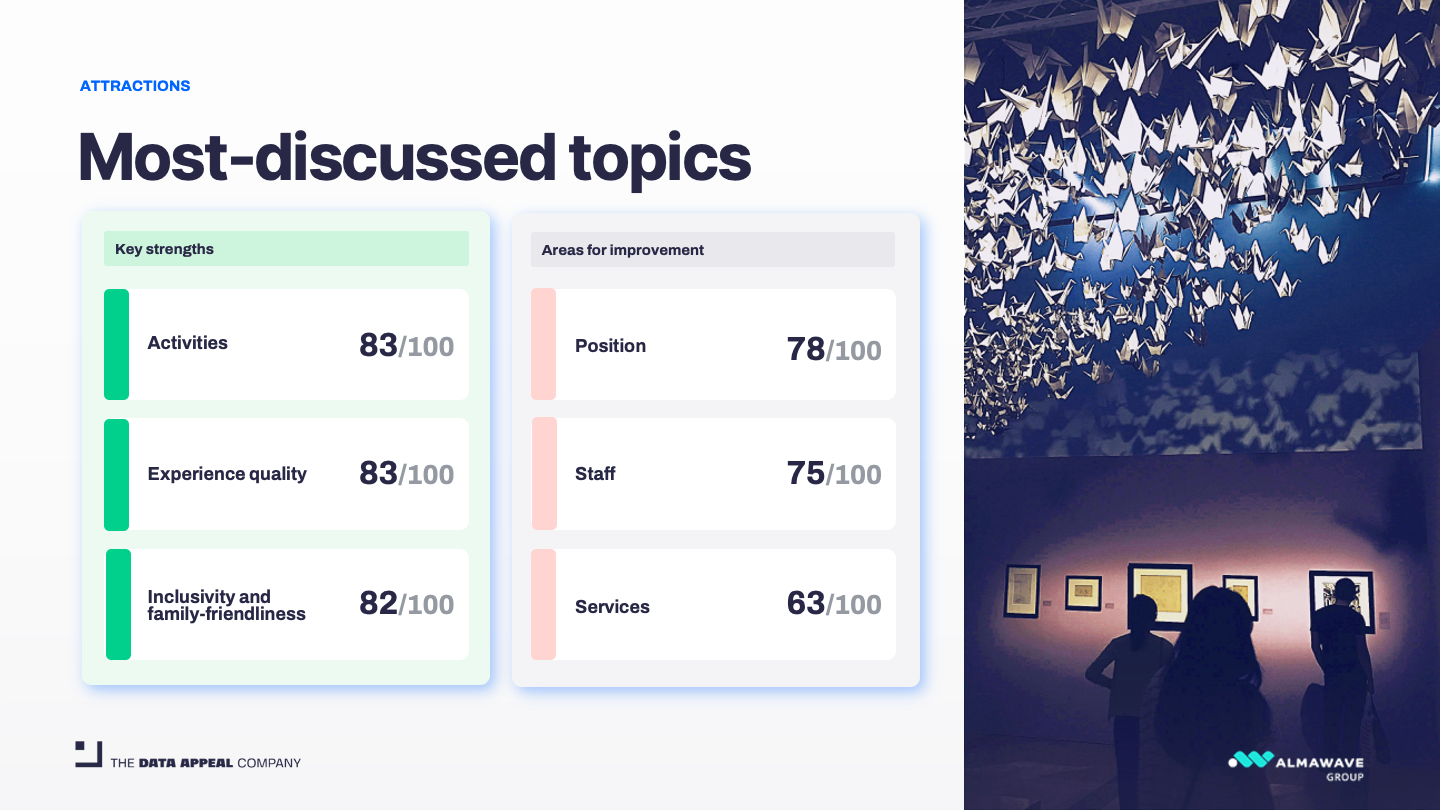

2. High satisfaction at museums highlights the need for better visitor services

Italy’s cultural treasures still draw fascination, yet the data uncovers some interesting trends. The Colosseum stands firm as the clear leader, with 51,200 mentions across various platforms and an impressive sentiment score of 92.1/100, reflecting the high regard visitors have for it.

The Trevi Fountain follows with 42,900 mentions (Sentiment Score: 88.5/100), and Milan Cathedral rounds out the top three with 26,700 (Sentiment Score: 93.7/100).

But here’s the surprise: the Leonardo da Vinci Museum in Florence scored 95.3/100—the highest sentiment rating among all top attractions.

This interactive, experiential museum outperformed even Italy’s most iconic landmarks, suggesting that hands-on, immersive cultural experiences resonate more deeply with modern travelers than passive observation.

Museums collectively punch well above their weight.

Despite representing just 6.7% of all attractions analysed, they generate 15% of total attraction content, with an impressive average sentiment of 90.2/100.

This overperformance indicates that quality cultural programming creates disproportionate engagement and satisfaction.

However, there’s a critical service gap holding Italy back.

However, there’s a critical service gap holding Italy back.

While overall attractions earn high marks (Sentiment Score: 89.6/100), supporting infrastructure scores just 63/100. Visitors consistently cite issues with services, long queues, and costs—areas where investment could significantly enhance Italy’s already strong cultural offering.

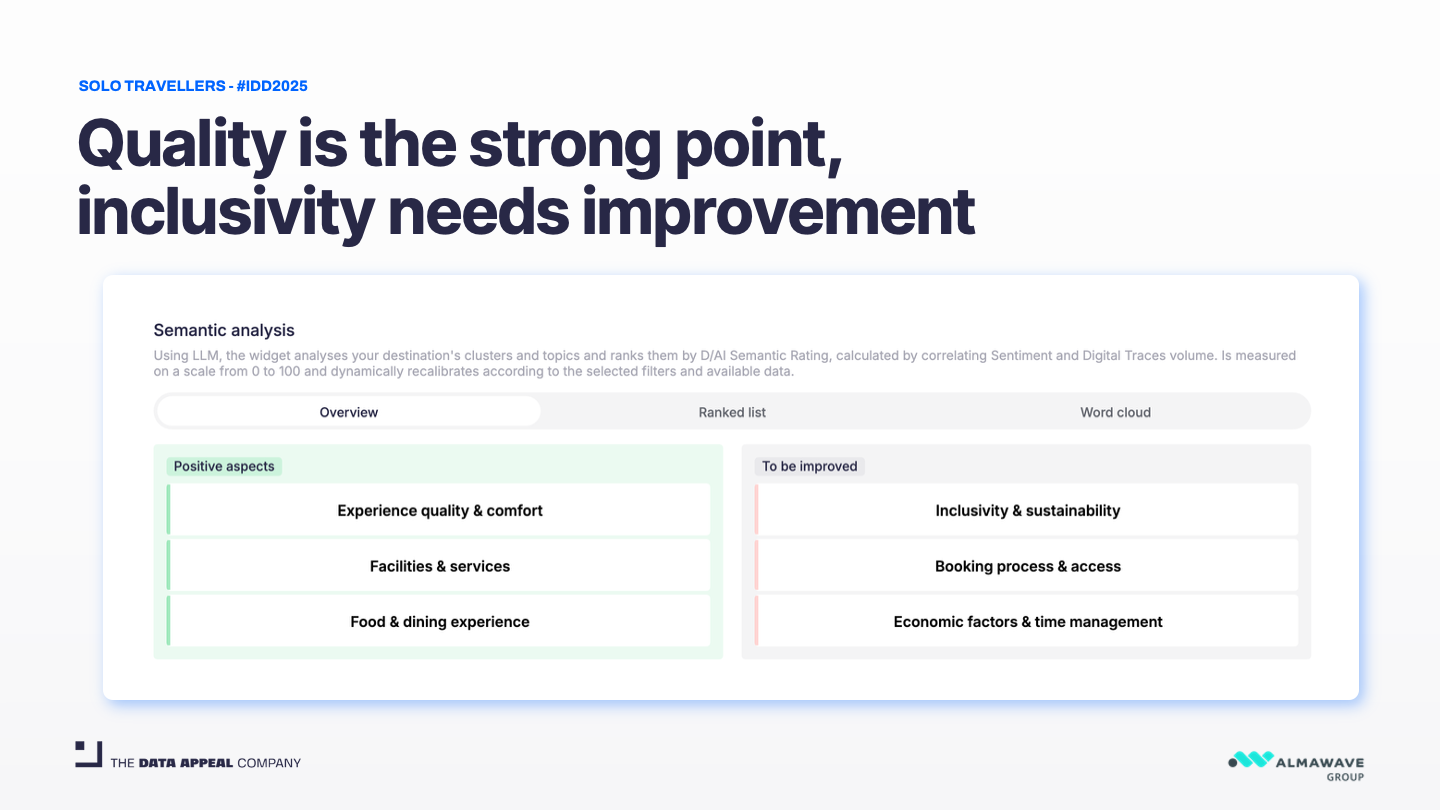

3. Solo travel rises 10% with satisfaction at 82/100, revealing untapped opportunities

Independent travel to Italy is experiencing remarkable growth, with digital traces up 10% and satisfaction at 82.3/100.

Italians constitute the largest group of solo travellers in their own country, making up nearly half of the total at 47.5%.

The hostel culture is thriving among solo travellers, particularly in major art cities. PLUS Florence leads with 3,100 mentions, followed by Anda Venice Hostel and Generator Venice. Rome’s JO&JOE and The RomeHello round out the top destinations for solo explorers.

What solo travellers appreciate most is straightforward: staff courtesy and food quality consistently earn high marks. The social atmosphere of hostels, combined with Italy’s legendary hospitality and cuisine, creates ideal conditions for independent exploration.

However, significant pain points remain.

Solo travellers specifically cite issues with inclusivity, value for money, and overall customer experience.

These gaps represent clear opportunities for Italian tourism businesses to better serve this growing, high-engagement segment. Solo travellers tend to stay longer, explore more deeply, and share their experiences more actively—making them particularly valuable visitors.

These gaps represent clear opportunities for Italian tourism businesses to better serve this growing, high-engagement segment. Solo travellers tend to stay longer, explore more deeply, and share their experiences more actively—making them particularly valuable visitors.

4. Short-term rentals outperform other sectors in visitor satisfaction

In a striking development, short-term rentals now achieve the highest satisfaction scores across all tourism sectors at 87.8/100—beating traditional hotels, B&Bs, and resorts. With 168,000 active properties representing 82% online presence, STRs have become a formidable force in Italian accommodation.

The STR revolution represents a fundamental shift toward immersive, authentic travel experiences over traditional tourist infrastructure.

5. Roots tourism: The emotional return

One of 2025’s most significant emerging trends is roots tourism—travellers returning to ancestral villages and regions where their families originated.

This deeply personal form of travel creates emotional connections that transcend typical sightseeing.

Basilicata exemplifies this trend, showing +2.0 growth compared to 2022 as a roots destination. This southern region attracts descendants of Italian emigrants seeking to walk streets their grandparents once knew, visit family churches, and reconnect with heritage.

Roots tourism matters because it disperses visitors to off-the-beaten-path destinations, supporting rural economies and creating year-round demand.

These travellers spend more time, invest in local experiences, and often return repeatedly, building lasting relationships with their ancestral communities. It’s tourism at its most meaningful—personal, emotional, and economically sustainable.

6. Travellers in Italy are looking for more than history and art

While culture remains the dominant demand driver at 28.4%, the motivations bringing people to Italy are diversifying significantly.

Nature tourism now accounts for 16% of demand; active lifestyle experiences represent 15.3%, and food and cuisine capture 15%.

This evolution signals Italy’s successful transition from mono-seasonal cultural tourism to a year-round, multi-experiential destination.

The rise of nature and active tourism particularly benefits shoulder and off-season months when outdoor conditions are often ideal. Rather than competing with summer crowds at the Uffizi, travellers increasingly seek experiences that blend cultural richness with outdoor adventure, culinary discovery with physical activity.

This diversification strengthens Italy’s tourism resilience, spreading economic benefits across regions and seasons while reducing pressure on over-touristed cultural sites.

7. Green spaces outperform theme parks

An illuminating contrast emerges when comparing green spaces to theme parks. Villa Borghese in Rome scores 93.1/100 sentiment, while Mirabilandia—Italy’s most popular theme park—manages just 77.5/100. Across the board, green spaces generated over 200,000 content pieces with an average sentiment of 87.8, significantly outperforming theme parks.

The reasons are clear. Theme parks often grapple with costs, queue management, and safety—factors that can impact the visitor experience. In line with growing outdoor trends, green spaces like Villa Borghese, Sempione Park in Milan (92.3/100), and Miramare Castle grounds in Trieste (95/100) offer a more tranquil alternative, providing an authentic Italian atmosphere that resonates with many travellers today.

8. More than summer crowds: International flights are diversifying Italy’s tourism

The infrastructure supporting Italy’s tourism boom is expanding impressively.

Seats available increased 3.5% YoY to 126.54 million, with flights up 2.9% to 719,700. This growth is mostly driven by low-cost carriers, which now represent 71.1% of all flights to and from Italy—a crucial shift in accessibility and affordability.

Poland leads growth at +34.2%, the fastest expansion of any major market. The United States is up 7.1%, Spain up 11.4%, demonstrating strong transatlantic and intra-European demand.

Even as domestic Italian flights declined 2.9%, international connectivity more than compensated, with international flights now representing 69.2% of total capacity.

This air connectivity surge doesn’t just mean more tourists—it means greater market diversity. Polish, American, Spanish, and Romanian visitors bring different expectations, travel patterns, and spending behaviours, enriching Italy’s tourism ecosystem and reducing dependence on any single source market.

This air connectivity surge doesn’t just mean more tourists—it means greater market diversity. Polish, American, Spanish, and Romanian visitors bring different expectations, travel patterns, and spending behaviours, enriching Italy’s tourism ecosystem and reducing dependence on any single source market.

9. Italy’s tourism thrives on a balance of foreign visitors and domestic explorers

Italy maintains a remarkably stable balance: 58.6% foreign visitors with 84/100 satisfaction, unchanged from the previous year.

This stability amid global travel volatility demonstrates Italy’s enduring international appeal.

But the dynamics beneath this headline figure reveal fascinating nuances. While foreign visitors dominate overall, Italians themselves lead the solo travel segment—creating a dual market where international groups explore iconic sites while domestic solo travellers rediscover their own country’s hidden corners.

The high foreign satisfaction score (84/100) indicates Italy successfully meets diverse international expectations—no small feat given the cultural differences between different markets of travellers. Maintaining this satisfaction while growing volume represents a delicate balance of preserving authenticity while accommodating modern tourist needs.

The big picture: Italy’s tourism transformation

These insights paint a picture of Italian tourism at an inflection point. The fundamentals remain extraordinarily strong—cultural treasures continue captivating millions, satisfaction stays high, and market share grows. But the how, when, and why of Italian tourism are transforming profoundly.

Travellers increasingly seek personal meaning over checklist sightseeing, whether through solo exploration of art cities, emotional returns to ancestral villages, or immersive stays in residential neighbourhoods. They document experiences through video rather than reviews, visit during shoulder seasons rather than summer peaks, and balance cultural immersion with outdoor adventure.

Italy’s opportunity lies in infrastructure investment that matches the quality of its experiences. The consistent service gaps across sectors represent the clearest path to elevating satisfaction further. But the core product remains unmatched: a country where every region offers distinctive culture, cuisine, landscapes, and traditions stretching back millennia.

As one data point makes clear, Italy now captures over one-third of Southern Europe’s travel demand. In a competitive Mediterranean market, that dominance reflects something simple yet profound: when travellers dream of Europe, increasingly they dream of Italy—not just as it was, but as it’s becoming.