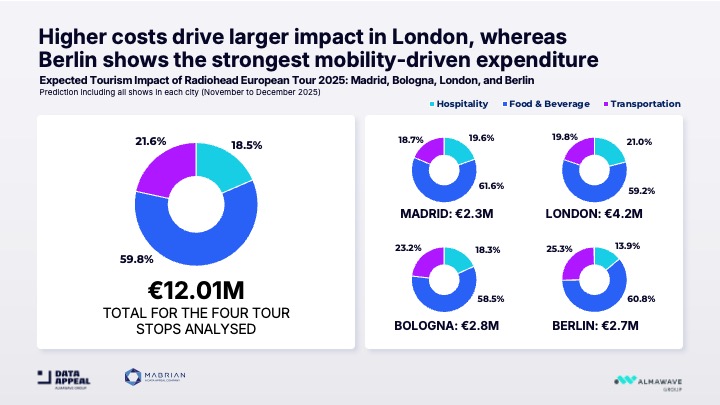

Everything’s in its right place for Radiohead fans—the legendary British band is back! The new tour consists of just a handful of dates, but according to Data Appeal and Mabrian, it will generate over 12 million euros in tourist spending across 4 of the concert destinations.

Seven years after their last show, Radiohead has announced a brief European tour that’s sparked massive excitement among fans. Getting your hands on a ticket has proven nearly impossible for many, but an analysis by Data Appeal and Mabrian shows the economic impact on host cities will be significant.

The concerts—scheduled for November/December 2025 with stops only in London, Berlin, Bologna, Madrid, and Copenhagen—were organised in an unusual way. Right from the start, Radiohead made it clear they wanted to crack down on ticket scalping and prioritise local community members through a verified, direct sales system managed by the band themselves.

Our analysis focuses on expected attendance and anticipated spending on accommodation, dining, and transportation for 16 concerts:

- Madrid, Spain: November 4, 5, 7, 8 at Movistar Arena

- Bologna, Italy: November 14, 15, 17, 18 at Unipol Arena

- London, UK: November 21, 22, 24, 25 at The O2

- Berlin, Germany: December 8, 9, 11, 12 at Uber Arena

What the numbers tell us: Accommodation takes a hit from ticket distribution strategy

The four cities analysed will host over 205,300 people for the Radiohead concerts, generating an economic impact of 12 million euros in tourism spending.

Of this total, food & beverage accounts for 59.9%, transportation for 21.6%, and accommodation for 18.5%.

These figures suggest that many attendees are planning day trips, short stays, or heading home immediately after the concert.

Compared to other major music events, the accommodation share is less significant. The ticket distribution strategy, designed to favour residents and people from neighbouring countries, steers spending towards dining and local transport rather than overnight stays. In other words: more meals and journeys, fewer hotel nights.

City-by-city differences: London is the destination generating the most spending

Each city shows different spending patterns, however. Let’s look in detail:

- In Madrid, where the Radiohead’s tour kicks off on 4 November, an estimated 2.3 million euros in tourism spending is expected across the four nights. Among all the cities analysed, the Spanish capital records the highest share of food & beverage spending, with 61.6% of the total dedicated to dining and gastronomy, followed by 19.6% for accommodation and 18.7% for transportation.

- In London, the expected overall tourism impact of up to 4.2 million euros is nearly double that of the other host cities, most likely due to higher costs for accommodation, dining, and transport. 59.2% of anticipated tourism spending relates to food & beverage, 21% to accommodation, and 19.8% to transportation.

- In Berlin, transport-related spending represents a comparatively higher share of the total: 25.3% of the overall 2.7 million euros. This indicates that many fans will be travelling from neighbouring regions and countries to attend the concerts.

- The same applies to Bologna, where transportation accounts for 23.2% of the expected tourism impact of over 2.8 million euros.

Events: A strategic asset for destinations

These are remarkable figures that offer a real-time gauge of the value and impact that major events generate on tourism, retail, and hospitality.

For local authorities, data is a strategic asset for planning interventions and investments, managing visitor flows, and optimising public services for the benefit of both residents and tourists.

Event analysis clearly demonstrates what a powerful lever it can be for destination managers, and how it should be considered among the fundamental KPIs to monitor in order to guide the growth and day-to-day operations of destinations.

Want to measure the impact of events in your destination?

Try D / AI Destinations for free